Introduction: The Backbone of Social Change

India is a nation of contradictions — home to the world’s fastest-growing economy and yet, millions struggle with access to education, healthcare, and a clean environment. Bridging this gap are Non-Governmental Organizations (NGOs) — the invisible architects of change who operate between citizens and the state, transforming policies into action.

From planting trees in drought-hit villages to educating children in slums, NGOs form the civil society sector that sustains democracy and compassion.

According to NITI Aayog’s NGO-DARPAN database, India has over 3.4 million registered NGOs, roughly one for every 400 citizens. Their size, structure, and scope vary widely — from small community groups to globally recognized organizations like Pratham, CRY, and Smile Foundation.

But what exactly is an NGO in India? How is it different from a company or a government body? What laws govern it? And how does it raise funds or qualify for tax benefits?

Let’s unpack everything, step by step.

What is an NGO?

The term “Non-Governmental Organization (NGO)” refers to any voluntary, non-profit, and independent organization working to promote social welfare, environmental protection, education, or human rights.

The phrase was first officially used by the United Nations in 1945 under Article 71 of its Charter, which recognized “international non-governmental organizations” as partners in consultative status with the UN’s Economic and Social Council (ECOSOC)【UNDP†source】.

In simple words:

An NGO is any non-profit organization that works for the public good and operates independently from government control, though it may collaborate with the government.

Objectives of NGOs

-

Social upliftment and poverty eradication

-

Education and skill development

-

Women empowerment and gender equality

-

Healthcare and sanitation

-

Environmental protection and climate action

-

Disaster relief and rehabilitation

-

Human rights and legal aid

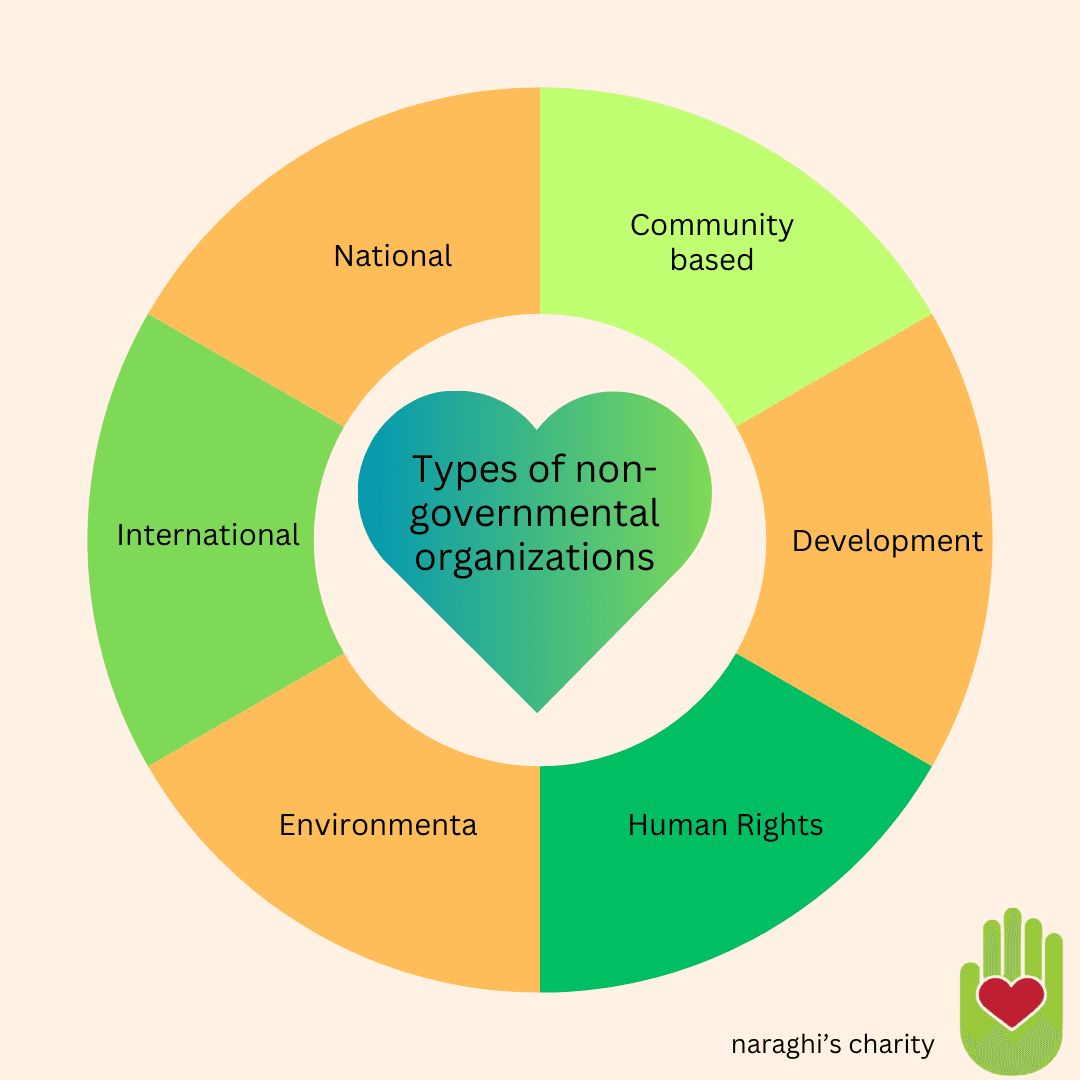

Globally, NGOs are often categorized as:

-

Operational NGOs – implement development projects on the ground.

-

Advocacy NGOs – influence policies, campaigns, and social awareness.

(Sources: UNDP, Britannica, Wikipedia)

NGO Meaning in the Indian Context

In India, “NGO” is not a separate legal entity. It is a collective term used to describe organizations that are legally registered under one of three main laws:

-

Indian Trusts Act, 1882 (or state-specific Public Trust Acts)

-

Societies Registration Act, 1860

-

Companies Act, 2013 – Section 8

Each of these laws gives NGOs a different structure, governance model, and reporting requirement.

Why There’s No “NGO Act”

India never created a single “NGO law.” Instead, it recognizes multiple charitable frameworks — allowing flexibility across faith-based trusts, member-driven societies, and corporate-style not-for-profits.

This diversity allows NGOs to choose a structure that best fits their mission, size, and level of accountability.

(Sources: Investopedia, Byju’s)

Types of NGOs in India (Legal Structures)

Public Charitable Trust

-

Governed by state-level laws such as the Bombay Public Trusts Act, 1950 in Maharashtra or the Tamil Nadu Public Trusts Act, 1972.

-

Established when one or more trustees hold property or funds for charitable purposes like education, relief, or religious welfare.

-

Trustees are custodians of assets but do not own them.

-

Examples: Missionaries of Charity (Kolkata), Ramakrishna Mission.

Pros:

-

Simple to register and maintain.

-

Ideal for family-run or long-term philanthropic projects.

Cons:

-

Less democratic — trustees are often self-appointed.

-

Amendments or changes require court approval.

2. Society

-

Registered under the Societies Registration Act, 1860, one of India’s oldest laws.

-

Managed by a governing body or executive committee, elected by members.

-

Must have at least seven members to register (in most states).

-

Ideal for educational institutes, cultural groups, or research bodies.

-

Example: Akshaya Patra Foundation (runs mid-day meal programs).

Pros:

-

Democratic structure; suitable for member-based organizations.

-

Flexible operations across states.

Cons:

-

Must hold annual general meetings.

-

Each state registrar has different filing rules.

3. Section 8 Company

-

Registered under the** Companies Act, 2013**, Section 8.

-

Functions like a corporate entity — with directors, MoA (Memorandum of Association), and audited accounts — but profits cannot be distributed to shareholders.

-

Must reinvest all surplus into social objectives.

-

Example: Teach For India, Centre for Science and Environment (CSE).

Pros:

-

High credibility — preferred for CSR partnerships.

-

National-level registration; recognized by corporate donors.

-

Structured governance like a company.

Cons:

-

Higher compliance costs and formalities.

-

Annual filings with MCA and audits mandatory.

(Sources: Wikipedia, Britannica)

How NGOs in India Get Tax Benefits

NGOs can enjoy** income-tax exemptions** and allow their donors to claim tax deductions — but only if they register under specific sections of the Income Tax Act, 1961.

Section 12AB – Income Tax Exemption

-

Replaced the older 12A and 12AA system in 2021.

-

NGOs with 12AB registration are exempt from paying tax on income used for charitable purposes.

-

The registration is valid for 5 years and must be renewed thereafter.

-

NGOs must maintain proper accounts and file Form 10B (Audit Report) annually.

Section 80G – Donor Tax Deduction

-

Encourages donations by allowing individuals and companies to deduct up to 50% of their donation from taxable income.

-

For example, if a person donates ₹1 lakh to an 80G-approved NGO, ₹50,000 is deductible.

-

Revalidation of 80G certificates every 5 years is mandatory (as per the CBDT circular of April 2021).

Fact Check

As of 2024, more than 1.3 lakh NGOs in India are registered under 12AB and 80G combined (source: Income Tax Department database).

(Sources: CBDT Circular No. 11/2021, ERA Environmental Blog

Foreign Funding Rules (FCRA 2010)

India’s Foreign Contribution (Regulation) Act (FCRA), 2010, governs how NGOs receive and use funds from abroad.

Objective

To ensure that foreign contributions do not influence political, economic, or social processes in India.

Key Provisions (Amended 2020–2025)

-

FCRA Registration or Prior Permission is compulsory before accepting any foreign donation.

-

Foreign funds must be received only in the designated SBI New Delhi Main Branch (NDMB) account.

-

NGOs cannot sub-grant FCRA money to other organizations.

-

Administrative expenses from foreign contributions cannot exceed 20% of total receipts.

-

All FCRA-registered NGOs must file Form FC-4 (annual return) online each year by December 31.

-

Key functionaries must have Aadhaar and comply with KYC norms.

-

2022–2025 amendments raised the relative-gift reporting threshold from ₹1 lakh to ₹10 lakh.

Penalties

Non-compliance can result in suspension or cancellation of registration. Between 2017–2023, over 20,600 NGOs lost their FCRA licenses due to irregularities, according to the Ministry of Home Affairs.

(Sources: MHA – FCRA Portal, NDTV 2023 Report)

Government Partnerships: NGO-DARPAN

The NGO-DARPAN portal managed by NITI Aayog serves as a national database for NGOs seeking government funding or recognition.

Key Features

-

Provides a unique DARPAN ID for registered NGOs.

-

Required for applying to Central or State government grants.

-

Displays basic details like contact info, areas of work, and key projects.

-

Promotes transparency between civil society and government agencies.

As of 2025, over 1.55 lakh NGOs are registered on the DARPAN portal (Source: NITI Aayog dashboard).

(Source: NGO DARPAN Portal)

Corporate Social Responsibility (CSR) and NGOs

India became the first country in the world to mandate CSR spending under Section 135 of the Companies Act, 2013.

CSR Rule

Companies with:

-

Net worth ≥ ₹500 crore,

-

Turnover ≥ ₹1,000 crore, or

-

Net profit ≥ ₹5 crore, must spend 2% of their average net profit (past 3 years) on social causes listed in Schedule VII — including environment, education, and rural development.

🧾 CSR-1 Registration (since 2021)

To be eligible for CSR funds, an NGO must:

-

Be registered as a Trust, Society, or Section 8 Company, and

-

File Form CSR-1 with the **Ministry of Corporate Affairs (MCA). **

After approval, the NGO receives a unique CSR Registration Number. Companies then file Form CSR-2 annually, listing their partner NGOs and projects.

Why it matters: CSR funding has grown into a ₹25,000+ crore ecosystem annually, with NGOs as primary implementation partners (Source: India CSR Outlook Report 2024).

(Sources: MCA CSR Rules, Bain & Co. India Philanthropy Report 2025)

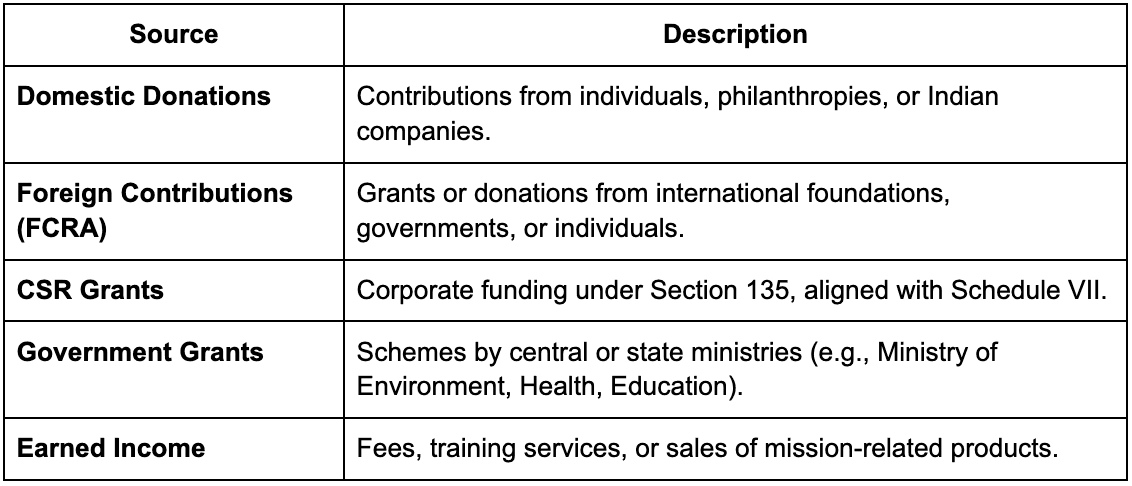

Funding Sources for Indian NGOs

(Source: Candid Learning Center)

Governance, Transparency, and Reporting

Good NGOs are not only mission-driven — they are data-driven and transparent.

Best Governance Practices

1. Independent Board – minimum 3 trustees/directors, with term limits.

2. Audited Financials – mandatory annual audits by a Chartered Accountant.

3. Public Disclosure – annual reports, donor lists, and project outcomes published online.

4. Internal Policies – anti-fraud, whistle-blower, and conflict-of-interest frameworks.

5. Compliance Calendar – timely filing of Income Tax, FCRA, MCA, and DARPAN updates.

Strong governance not only ensures legal compliance but also builds donor confidence and public trust.

(Source: Harvard Law School – OPIA)

Challenges Facing NGOs in India

Despite being a pillar of progress, NGOs face multiple challenges in India:

1. Complex Compliance

Managing registrations (12AB, 80G, FCRA, CSR-1, NGO-DARPAN) requires expertise and constant renewal — small NGOs often struggle to meet deadlines.

2. Funding Instability

With FCRA cancellations and stricter scrutiny, foreign funding has declined. According to the MHA, foreign inflows to NGOs dropped from ₹17,500 crore (FY2016) to ₹13,000 crore (FY2023).

3. Transparency & Trust Deficit

A few cases of misuse have led to general skepticism, affecting genuine organizations.

4. Talent Retention

NGOs often can’t match corporate salaries, leading to high staff turnover.

5. Administrative Caps

The 20% FCRA admin expense limit makes it hard for NGOs to invest in operations and systems.

(Sources: MHA Annual Reports, India Philanthropy Report 2025 – Bain & Co.)

The Role and Future of NGOs in India

NGOs act as innovation labs for social change — testing ideas that governments later scale. Whether it’s the mid-day meal program (first piloted by NGOs like Akshaya Patra) or community forestry, their work defines India’s path toward sustainability and inclusion.

The future will demand:

-

Digital transformation (data management, impact dashboards)

-

Collaborations with corporates and government

-

Outcome-based funding tied to measurable results

-

Transparency through tech (geo-tagging, blockchain donations)

As India moves toward its Net-Zero 2070 and SDG 2030 goals, NGOs will remain critical partners in execution — from reforestation to renewable energy awareness.

(Sources: UNDP India SDG Tracker, EIB – Triple Bottom Line)

🌿 Conclusion

An NGO in India is not just a legal entity — it’s a social contract. It represents the collective conscience of a nation — people helping people, citizens protecting nature, and communities shaping their destiny.

Whether registered as a Trust, Society, or Section 8 Company, every NGO is built on one principle:

Serve without profit, act with purpose, and sustain with integrity.

At CATCH Foundation, we embody this spirit through our forests, awareness drives, and partnerships that turn compassion into measurable climate action. Because at the heart of every strong society lies a stronger community — and NGOs are the heartbeat of that community.

📚 References

-

MCA – CSR Rules & Forms

-

Income Tax Dept – 12AB & 80G

-

India Philanthropy Report 2025 – Bain & Co.

🌱Frequently Asked Questions (FAQ Schema)

1. What is an NGO in India?

An NGO in India is a Non-Governmental Organization — a voluntary, non-profit group working for public welfare, independent of government control. NGOs in India are legally formed as Trusts, Societies, or Section 8 Companies under Indian law. They work in areas like education, healthcare, women’s empowerment, and the environment.

2. What are the types of NGOs in India?

India recognizes three main types of NGOs:

1. Public Charitable Trusts – governed by state trust laws.

2. Societies – registered under the Societies Registration Act, 1860.

3. Section 8 Companies – incorporated under the Companies Act, 2013. Each differs in structure, governance, and reporting but all operate on a not-for-profit basis.

(Sources: Britannica, Byjus)

3. How can I register an NGO in India?

To register an NGO in India:

-

Choose a legal structure (Trust, Society, or Section 8 Company).

-

Register with the state registrar or MCA.

-

Apply for PAN, then for 12AB (tax exemption) and 80G (donor deduction).

-

If receiving foreign funds, get FCRA registration from the MHA.

-

For CSR partnerships, file CSR-1 with the Ministry of Corporate Affairs.

(Sources: MHA FCRA Portal, MCA)

4. What is 12AB and 80G registration for NGOs?

-

12AB gives NGOs income tax exemption on their charitable income.

-

80G allows donors to claim tax deductions on donations (usually 50%). Both registrations are valid for 5 years and must be renewed through the Income Tax e-filing portal.

(Sources: Income Tax Dept)

5. What is FCRA and why do NGOs need it?

The Foreign Contribution (Regulation) Act, 2010 (FCRA) regulates foreign donations to Indian NGOs. It ensures funds are used transparently for approved purposes. To receive any foreign contribution, NGOs must:

-

Register under FCRA,

-

Open a designated SBI NDMB account,

-

Cap administrative expenses at 20%, and

-

File annual returns (Form FC-4).

(Sources: MHA FCRA Portal)

6. How do NGOs get CSR funds from companies?

Under India’s** Companies Act, 2013 (Section 135)**, large companies must spend 2% of their net profit on CSR. To receive CSR funding, NGOs must:

-

Register in Form CSR-1,

-

Have a valid 12AB and 80G,

-

Align projects with Schedule VII of the Act, and

-

Provide audited financials and progress reports to corporate partners.

(Sources: MCA CSR Rules)

7. What is NGO-DARPAN and why is it important?

NGO-DARPAN is a national portal managed by NITI Aayog that provides NGOs a unique ID for government collaboration. It improves transparency and is mandatory for receiving government grants or schemes.

(Source: NITI Aayog – NGO DARPAN)

8. Can NGOs make profit in India?

NGOs in India can generate revenue through donations, services, or products, but cannot distribute profits to members or directors. All income must be reinvested to achieve the NGO’s charitable objectives.

(Sources: Investopedia)

9. How many NGOs are registered in India?

As per NITI Aayog’s NGO-DARPAN database, there are over 3.4 million registered NGOs in India — roughly one for every 400 citizens. However, only a fraction are actively compliant with 12AB, 80G, or FCRA registrations.

(Sources: NITI Aayog Data 2024)

10. Why are NGOs important in India?

NGOs fill critical gaps in education, health, environment, and livelihood where government programs can’t reach. They strengthen democracy, drive innovation, and mobilize communities for sustainable development. Without NGOs, India’s progress toward the UN Sustainable Development Goals (SDGs) would be far slower.

(Sources: UNDP India, EIB)